Cox Specialized Commercial Property Fund, LP

Multi-Type Storage Private Equity Offering

This one-of-a-kind fund capitalizes on a growing demand and a vast undersupply of three property types — RV and Boat Storage, Self-Storage and Industrial Storage — offering a well timed investment opportunity.

RV and Boat Storage Facilities

Self-Storage Facilities

Industrial Storage

Investment Strategy

Target Acquisitions

Qualified properties must be located in high growth markets and possess a clear path to value creation strategies including, expansion or redevelopment of stabilized facilities, and adaptive reuse of properties priced well below replacement cost.

Diversification

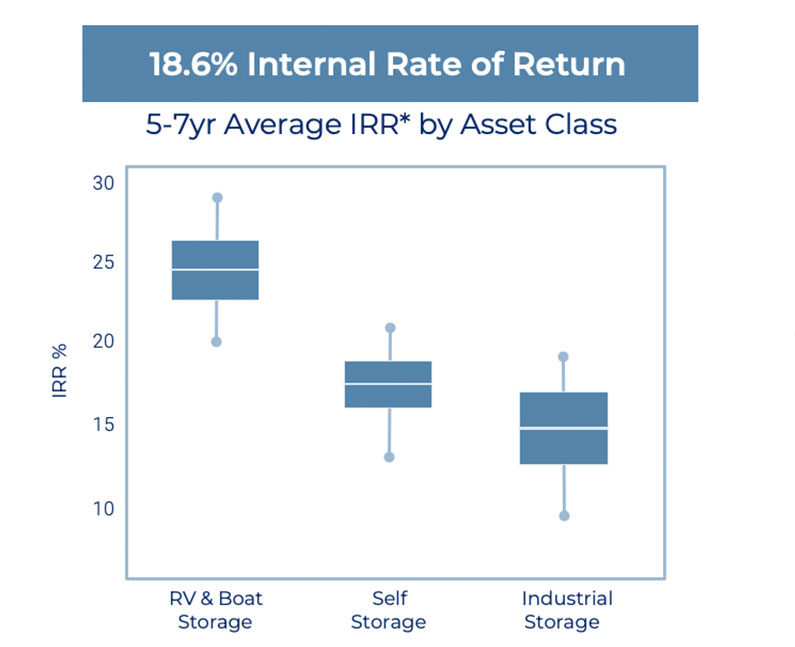

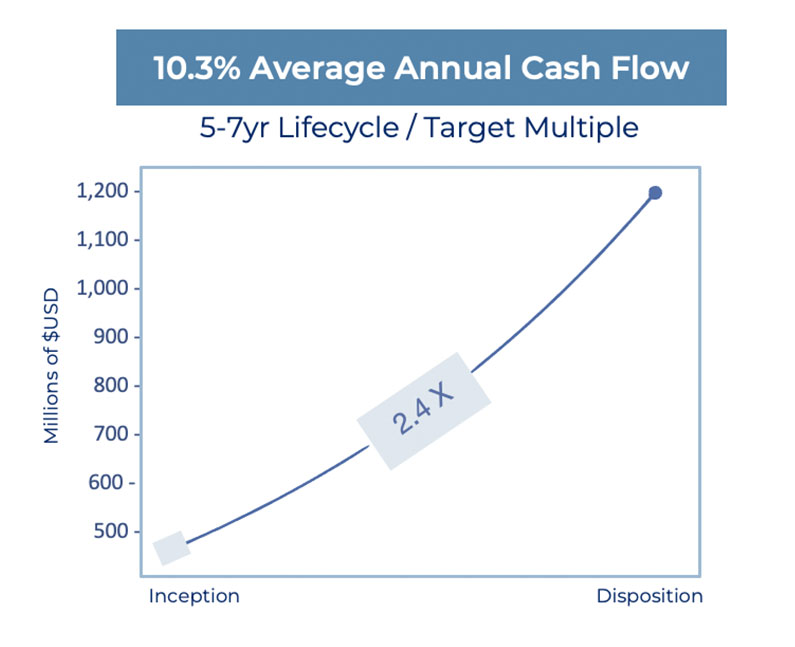

Our growth strategy is designed to generate risk-adjusted returns throughout a variety of fluctuating economic scenarios by creating new assets while simultaneously balancing the risk profile with equity in stabilized, cash-flowing properties.

Conservative Leverage Practices

Use of leverage should be applied after capital improvements are complete and when cash flow is sufficient to maintain a positive return on equity. This expedites development and lowers risk while providing the least expensive capital structure.

Complimentary Property Types

There is great potential for growth by creating “hybrid” facilities with the addition of RV and Boat Storage. Existing Self-Storage and Industrial Storage facilities are prime candidates for added value as they share zoning, tenants and operating expenses.

Our Approach

- Our management team brings decades of expertise across a number of key aspects, such as: acquisitions, design, engineering, development, construction and management. This broad experience enables our managers to bring operations in-house and allows us to run efficiently and have better control over outcomes – the hallmark of a vertically integrated fund.

- We recognize the importance of strategically timed acquisitions and a diversified portfolio in order to drive both optimal cash flow and maximum exit valuation. It is with this in mind that we include a range of property types including core+, value-add, opportunistic and ground-up development with tenants from multiple economic sectors.

- By blending strategy types across multiple asset classes, we can dial in our targeted risk-reward ratio for the fund, allowing us to create a more robust portfolio. We gain additional control by diversifying across growth markets in the Sunbelt while remaining open to special opportunities within any of the lower 48 states.

NOTICE: FOR VERIFIED ACCREDITED INVESTORS ONLY PER RULE 506(c) OF REGULATION D PROMULGATED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND/OR OTHER APPLICABLE U.S. FEDERAL AND STATE EXEMPTIONS FROM REGISTRATION. The material and content presented herein is qualified in its entirety by an offering memorandum (the “Memorandum”) which contains more complete information including risk factors. The material and content herein contains forward-looking statements and hypothetical economic forecasts that may not be realized. Please read the entire Memorandum. Without limiting the foregoing, this material and content do not constitute an offer or solicitation in any jurisdiction in which such an offer or solicitation is not permitted under applicable law or to any person or entity who is not an “accredited investor” as defined under Rule 501(a) of the U.S. Securities Act of 1933, as amended, and/or who does not possess the necessary qualifications described in the Memorandum and/or applicable exemptions under the U.S. Securities Act of 1933, as amended. Please read the entire Memorandum.

TO OBTAIN FURTHER INFORMATION, PLEASE CONTACT US